The property market continues its steady recovery 📈. As momentum builds, buyer demand, transaction levels, and prices are rising. All eyes are on the Bank of England for an imminently expected interest rate cut 🤞.

Interest Rate 💹

The UK economy grew by 0.6% between January and March 2024, marking the end of the recession (ONS). With inflation falling to just 2.3% in the 12 months to April 2024, close to its 2% target (ONS), the Bank of England is widely anticipated to cut the base rate imminently. Economists at Capital Economics are forecasting the base rate to be at 4.5% by the end of 2024, with the first cut expected in August. With the economic outlook brightening, consumer confidence in May rose to its highest level since December 2021 (GfK Consumer Confidence Tracker).

Market Dynamics 📈

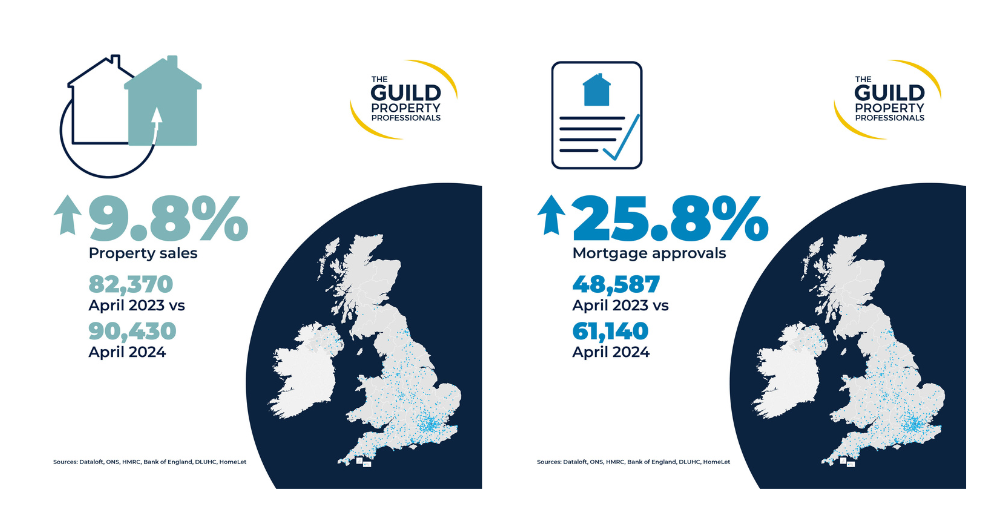

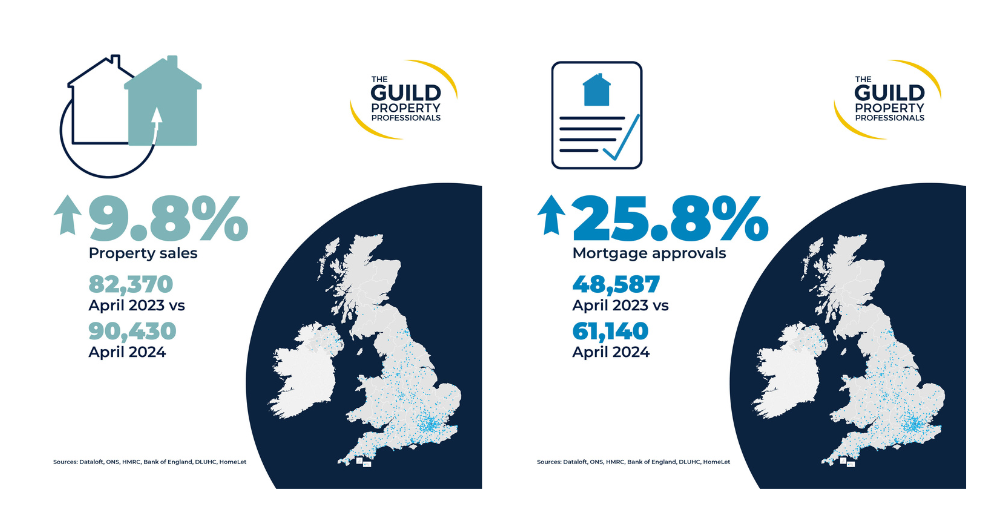

Despite borrowing costs being more expensive than the ultra-low period a few years ago, the recent stability has meant that homeowners can be confident in their ability to afford a mortgage and can benefit when rates do fall. With a widely expected base rate cut alongside the usual spring optimism, almost two-thirds of agents say that buyer confidence has improved compared to three months ago (Dataloft by PriceHubble (poll of subscribers)). Mortgage approvals reached 61,140 in April, a significant annual increase of 26% and only the second month since August 2022 that approvals have topped 61,000 (Bank of England).

Election 🗳️

Rishi Sunak has announced a 4th July general election. Some fear an election could stall market activity, but this was typically when a significant policy change, such as Mansion tax, was mooted, which isn’t the case this time round. The first interest rate drop is expected to have a larger impact on activity this year. The election is unlikely to interrupt seasonal patterns of transactions, which typically peak in July and August anyway (Dataloft (PriceHubble), HMRC). With the sales pipeline already 3% higher than this time last year (Zoopla), it's unlikely that buyers already in the process of working to a sale will pull out.

If you have any property related queries we are here and ready to help.

📞 01474 321 957

📧 sales@mandmprop.co.uk