What does the Renters’ Rights Bill look like from a legal perspective, and what does it mean for landlords, agents, and tenants? 🤔 A recent article in 'The Negotiator' looked at just that. 📄

A bill that will radically change the PRS was published last week (11th September 2024). The bill has begun its passage through Parliament after receiving its first reading and is scheduled to become law next year. Here we look at the main points affecting landlords, tenants, and letting agents.

Our Director, Sarah, had the privilege of recording a podcast for ellenor 🎤 on the importance of Collaboration and Fundraising 🤝 and the critical role it plays not only for the charity but for the broader community 🌍 and businesses like ours.

Superstitious homebuyers seem to be avoiding moves on Friday the 13th 🙅♂️, but according to Rightmove, when it comes to house numbers, this could work in a buyers' favour! 🍀

The previous Conservative government failed to fulfill its promise to abolish Section 21 notices, but the new Labour government appears committed to delivering on this issue.

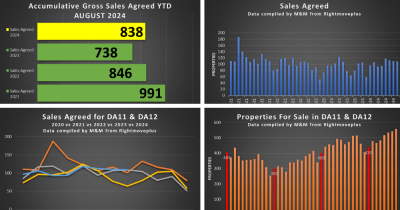

The Gravesham Property Market (DA11 & DA12). Here we look at the data for new listings, sales and the time its currently taking to sell a property. Data up to August 31st, 2024 📅

With the festive season fast approaching, many buyers dream of being settled in their new home by Christmas. The good news is that it’s possible—but it requires careful planning, swift decision-making, and a clear understanding of the home-buying process.

You likely have an emotional attachment to your home ❤️, so is it a good idea to rent it out? 🤔 Here Gemma looks at what you should consider before making this important decision.

There are 3 FREE ways we value your home: instant, online, and face-to-face. Here, Richard looks at which one is right for you. 🤔

Here, Steph looks at what you should consider and how to manage the process of increasing rents. 💰

Here, Steph offers her advice on what tenants should do if they are looking to leave their rented home. 👇

ellenor is an amazing local charity that provides hospice care for adults and children. ❤️ What's going on, and how can you get involved? 🤔