Our Quarterly Market Report is Now Available 📊

With a more positive outlook for autumn, confidence should continue to return to the housing market, as inflation remains under control and interest rates are now taking their first steps downwards.

Interest rate

The Bank of England delivered its first interest rate cut in more than four years, taking the rate from 5.25% to 5%. The Governor has emphasised a cautious approach, highlighting that 'we need to make sure inflation stays low and be careful not to cut 'too quickly or by too much'. One, or possibly two cuts are expected before the end of 2024, currently forecast to reach 4.75% by the year end*.

* (HM Treasury, Average of Independent Forecasts)

Solid activity

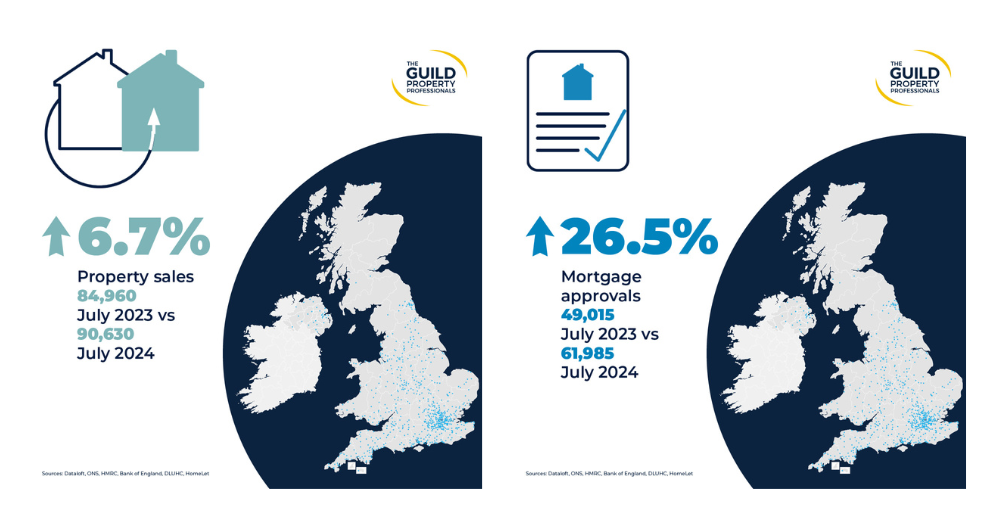

The housing market has proved resilient and fared better than many expected at the start of the year. Despite the added dynamic of the General Election, consumer confidence remains buoyant. Mortgage approvals for house purchases in the UK reached 62,000 in July, their highest level in almost two years. This represents a 2.3% increase from the previous month and a 26% rise compared to a year ago (Bank of England). With improving sentiment, the latest consensus forecast predicts 2.2% house price change through 2024, up from a 2024 forecast of -2.2% at this time last year (HM Treasury Average of Independent Forecasts).

Transactions building

Stable prices offer welcome increased certainty to buyers and sellers, in this context there is an expectation that transaction activity will increase. Transaction levels in July were 6.7% higher than a year ago (HMRC). Markets are pricing in a further interest rate cut this year, meaning transaction volumes are expected to be stronger than autumn last year. Almost a third (32%) of agents say transaction levels are higher than three months ago (Dataloft by PriceHubble (Poll of Subscribers)). In line with this sentiment, expectations for sales volume for the next three months have reached their most upbeat level since January 2020 (RICS).

If you have any property related queries we are here and ready to help.

📞 01474 321 957

📧 sales@mandmprop.co.uk

📧 letting@mandmprop.co.uk